Manulife Financial Corporation Stock Basis

- Manulife Financial Corporation Stock Basis Price

- Manulife Financial Stock

- Manulife Financial Corporation Stock History

TORONTO – Manulife Financial Corporation (“Manulife”). 2018, holders thereof will be entitled to receive fixed rate non-cumulative preferential cash dividends on a quarterly basis, as and when declared by the Board of Directors of Manulife and subject to the provisions of the Insurance Companies Act (Canada). The Toronto Stock. About Manulife Financial Corp Manulife Financial Corporation provides financial protection products and investment management services to individuals, families, businesses, and groups.

Manulife Financial Corporation has retained Keane to contact Canadian shareholders of MFC common shares whose account status at our Stock Transfer Agent, AST (Canada) is considered dormant or may have uncashed dividend checks or both. Manulife Financial Corporation, together with its subsidiaries, provides financial advice, insurance, and wealth and asset management solutions for individuals, groups, and institutions in Asia, Canada, and the United States.

Latest News

Manulife Investment Management Announces Changes To Risk Ratings On Select Exchange-traded Funds

C$ unless otherwise statedTSX/NYSE/PSE: MFC SEHK: 945 TORONTO, Aug. 20, 2019 /CNW/ - Manulife Investment Management today announced that the risk ratings of certain of its exchanged-traded funds (' Manulife ETFs') have changed as described below.

Manulife Financial Corp. (TSX:MFC) (NYSE:MFC) is well set up for a strong 2019 as interest rates continue to rise, with strong earnings and dividend growth. One an insurance stock and one bank.

Ex-Dividend Reminder: Manulife Financial, Sapiens International And Plantronics

Looking at the universe of stocks we cover at Dividend Channel, on 8/19/19, Manulife Financial Corp , Sapiens International Corp NV , and Plantronics, Inc. will all trade ex-dividend for their respective upcoming dividends.

Manulife Supports Measures To Reduce Medication Costs In Canada

TSC$ unless otherwise statedTSX/NYSE/PSE: MFC SEHK: 945 TORONTO, Aug. 9, 2019 /CNW/ - Earlier today the Government of Canada announced changes to the Patented Medicine Price Review Board.

Julie Dickson And Guy Bainbridge Appointed To Manulife's Board Of Directors

C$ unless otherwise statedTSX/NYSE/PSE: MFC SEHK: 945 TORONTO, Aug. 7, 2019 /PRNewswire/ - Manulife today announced that Julie Dickson and Guy Bainbridge have been appointed to its Board of Directors, effective August 7, 2019.

Manulife Financial Corporation Declares Preferred Share Dividends

C$ unless otherwise stated TSX/NYSE/PSE: MFC SEHK: 945 TORONTO, Aug.

Manulife Financial Corporation Declares Common Share Dividend

C$ unless otherwise statedTSX/NYSE/PSE: MFC SEHK: 945 TORONTO, Aug. 7, 2019 /PRNewswire/ - Manulife Financial Corporation's Board of Directors today announced a quarterly shareholders' dividend of $0.

Manulife Reports 2Q19 Net Income And Core Earnings Of $1.5 Billion

C$ unless otherwise stated TSX/NYSE/PSE: MFC SEHK: 945 This earnings news release for Manulife Financial Corporation ('Manulife' or the 'Company') should be read in conjunction with the Company's Second Quarter 2019 Report to Shareholders, including our..

John Hancock Multimanager Model Portfolios Now Available On The Envestnet Platform

C$ unless otherwise stated TSX/NYSE/PSE: MFC SEHK: 945 BOSTON, Aug. 6, 2019 /PRNewswire/ - John Hancock Investment Management, a Manulife Investment Management company, and a provider of multimanaged asset allocation investment solutions since 1995,..

Manulife Investment Management Announces Changes To Risk Ratings And Other Changes On Select Funds

C$ unless otherwise statedTSX/NYSE/PSE: MFC SEHK: 945 TORONTO, July 25, 2019 /CNW/ - Manulife Investment Management today announced that it will make the following changes effective on or about August 1, 2019: Change the risk ratings on select funds..

Trying To Stay Instaworthy But Hitting Instadebt? You're Not Alone.

Manulife Bank debt survey shows 38 per cent of Canadians living with debt admit it was because they lived beyond their means One in three (33 per cent) Canadians say their spending growth outpaces their income growth.

Manulife To Release Second Quarter Financial Results

C$ unless otherwise statedTSX/NYSE/PSE: MFC SEHK: 945 TORONTO, July 24, 2019 /PRNewswire/ - Manulife Financial Corporation will release its second quarter results following the market close on the evening of Wednesday, August 7, 2019.

John Hancock Hedged Equity & Income Fund And John Hancock Financial Opportunities Fund Release Earnings Data

BOSTON, July 10, 2019 /PRNewswire/ - John Hancock Hedged Equity & Income Fund (NYSE: HEQ) and John Hancock Financial Opportunities Fund (NYSE: BTO) announced earnings 1 for the three months ended June 30, 2019.

Manulife Floating Rate Senior Loan Fund (TSX: MFR.UN) Announces Normal Course Issuer Bid

C$ unless otherwise stated TSX/NYSE/PSE: MFC SEHK: 945 TORONTO, July 10, 2019 /CNW/ - Manulife Investment Management announced today that the Manulife Floating Rate Senior Loan Fund (the 'Fund'), a..

John Hancock Closed-End Funds Declare Monthly Distributions

BOSTON, July 1, 2019 /PRNewswire/ - The five John Hancock closed-end funds listed below declared their monthly distributions today as follows: Declaration Date: July 1, 2019 Ex Date: July 10, 2019 Record Date: July 11, 2019 Payment Date: July 31, 2019 ..

John Hancock Tax-Advantaged Dividend Income Fund Notice To Shareholders - Sources Of Distribution Under Section 19(a)

BOSTON, June 28, 2019 /PRNewswire/ - John Hancock Tax-Advantaged Dividend Income Fund (NYSE: HTD) (the 'Fund'), a closed-end fund managed by John Hancock Investment Management (US) LLC and subadvised by both Manulife Investment Management (US) LLC, and..

John Hancock Premium Dividend Fund Notice To Shareholders - Sources Of Distribution Under Section 19(a)

BOSTON, June 28, 2019 /PRNewswire/ - John Hancock Premium Dividend Fund (NYSE: PDT) (the 'Fund'), a closed-end fund managed by John Hancock Investment Management LLC and subadvised by Manulife Asset Management (US) LLC, announced today sources of its..

John Hancock Hedged Equity & Income Fund Required Notice To Shareholders - Sources Of Distribution Under Section 19(a)

BOSTON, June 28, 2019 /PRNewswire/ - John Hancock Hedged Equity & Income Fund (NYSE: HEQ) (the 'Fund'), a closed-end fund managed by John Hancock Investment Management LLC (the 'Adviser') and subadvised by Wellington Management Company LLP (the..

AM Best Affirms Credit Ratings Of Manulife Financial Corporation And Its Subsidiaries

AM Best has affirmed the Financial Strength Rating (FSR) of A+ (Superior) and the Long-Term Issuer Credit Ratings (Long-Term ICR) of 'aa-' of the life/health insurance subsidiaries of Manulife Financial Corporation (MFC) (Toronto, Canada) [NYSE: MFC].

Manulife Investment Management's Global Intelligence Report Sees Opportunity Despite Uncertainty Over The Next 12 Months

Room for expansion in the credit cycle and notable investment potential in private infrastructure and select emerging markets amid market muddle Explores climate change as a key factor in portfolio management Looks at opportunities in liability-driven..

Manulife Investment Management Announces Cash Distributions For Manulife Exchange Traded Funds

C$ unless otherwise statedTSX/NYSE/PSE: MFC SEHK: 945 TORONTO, June 20, 2019 /CNW/ - Manulife Investment Management today announced the June 2019 cash distributions for Manulife Exchange Traded Funds (ETFs) that distribute semi-annually.

A Deeply Undervalued Dividend Stock From the North

With its high dividend yield, Manulife investors are paid well to be patient.

Manulife President And CEO Roy Gori To Speak At True North Conference

Manulife Financial Corporation Stock Basis Price

C$ unless otherwise stated TSX/NYSE/PSE: MFC SEHK: 945 TORONTO, June 12, 2019 /CNW/ - Roy Gori, President and Chief Executive Officer of Manulife, will speak at the True North Conference on Wednesday June 19, 2019.

ALL-IN! Manulife Bank Shows Banking Can Be Done Differently

Help Canadians maximize their money with the new Manulife All-In Banking Package™ Open four banking products online in four minutes Offers Canadians value far beyond just a big bank chequing account Unlimited No-fee banking when Canadians save as little..

Manulife Financial Corporation Announces Results Of Conversion Privilege Of Non-cumulative Rate Reset Class 1 Shares Series 15

C$ unless otherwise stated TSX/NYSE/PSE: MFC SEHK: 945 TORONTO, June 5, 2019 /PRNewswire/ - Manulife Financial Corporation ('Manulife') today announced that after having taken into account all election notices received..

John Hancock Closed-End Funds Declare Quarterly Distributions

BOSTON, June 3, 2019 /PRNewswire/ -- The five John Hancock closed-end funds listed below declared their quarterly distributions today as follows: Declaration Date: June 3, 2019Ex Date: June 12, 2019Record Date: ..

John Hancock Closed-End Funds Declare Monthly Distributions

BOSTON, June 3, 2019 /PRNewswire/ -- The five John Hancock closed-end funds listed below declared their monthly distributions today as follows: Declaration Date: June 3, 2019Ex Date: June 12, 2019Record Date: ..

Manulife Financial Corporation Announces Dividend Rates On Non-cumulative Rate Reset Class 1 Shares Series 15 And Non-cumulative Floating Rate Class 1 Shares Series 16

C$ unless otherwise stated TSX/NYSE/PSE: MFC SEHK: 945 TORONTO, May 21, 2019 /PRNewswire/ - Manulife Financial Corporation ('Manulife') today announced the applicable dividend rates for its Non-cumulative Rate Reset..

John Hancock Closed-End Funds Release Earnings Data

BOSTON, May 15, 2019 /PRNewswire/ -- The eight John Hancock Closed-End Funds listed in the table below announced earnings 1 for the three months ended April 30, 2019.

From Our Partners

Manulife headquarters on Bloor Street of Toronto, Ontario. | |

| The Manufacturers Life Insurance Company | |

| Public company | |

| Traded as | TSX: MFC NYSE: MFC SEHK: 945 PSE: MFC |

|---|---|

| Industry | Financial Services (Insurance) |

| Founded | 1887; 132 years ago |

| Headquarters | Toronto, Ontario, Canada |

| Roy Gori, president and chief executive officer Richard DeWolfe, chairman of the board of directors | |

| Products | Asset management, Commercial banking, Commercial Mortgages, Consumer banking, Group benefits, Insurance, Investments, Mutual funds, Private banking, Real estate, Real estate, Reinsurance, Securities, Underwriting, Wealth Management |

| Revenue | CA$53.3 billion (2016)[1] |

| CA$2.2 billion (2015)[1] | |

| AUM | CA$935 billion (2015)[1] |

| Total assets | CA$705 billion (2015)[1] |

| Total equity | CA$42 billion (2015)[1] |

| 34,000 employees and 63,000 agents (2015)[2] | |

| Subsidiaries | |

| Website | www.manulife.com |

Manulife Financial Corporation (also known as Financière Manuvie in Quebec) is a Canadian multinational insurance company and financial services provider headquartered in Toronto, Ontario, Canada. The company operates in Canada and Asia as 'Manulife' and in the United States primarily through its John Hancock Financial division.[3] As of December 2015, the company employed approximately 34,000 people and had 63,000 agents under contract, and has CA$935 billion in assets under management and administration.[2] Manulife services over 26 million customers worldwide.[4]

Manulife is the largest insurance company in Canada and the 28th largest fund manager in the world based on worldwide institutional assets under management (AUM).[5]

Manulife Bank of Canada is a wholly owned subsidiary of Manulife.

- 1History

History[edit]

Manulife was incorporated as 'The Manufacturers Life Insurance Company' by Act of Parliament on 23 June 1887 and was headed by Canada's prime minister, John A. Macdonald, and Ontario's lieutenant-governor, Alexander Campbell (there were no conflict-of-interest guidelines at the time and it was not unusual for public persons to be involved in private industry). The idea for the company came from J. B. Carlile, who came to Canada as an agent for the North American Life Assurance Company. It was his first-hand experience on which the new company's product portfolio was based.[6]

Private stock company[edit]

The firm was founded as The Manufacturers Life Insurance Company in 1887. Its first president was John A. Macdonald, the first Prime Minister of Canada. The company sold its first policy outside of Canada in Bermuda in 1893. In 1894, policies were sold in Grenada, Jamaica and Barbados; Trinidad and Tobago, and Haiti in 1895; and British Honduras, British Guiana, China and British Hong Kong in 1897.[7][8]

In 1901, Manulife amalgamated with the Temperance and General Life Assurance Company,[6] a Toronto-based Canadian life insurer that provided preferred rates to abstainers of alcohol. Manulife continued to offer abstainers rates into the 1920s.[8]

In 1931, it opened its first southern China branch in British Hong Kong. Shortly thereafter, it established itself as a leading life insurer in the region with branches in Macau, Shantou and Amoy.[9]

Mutual company[edit]

In 1958, shareholders voted to change its legal form from a joint stock company to a mutual organization, making the company privately owned by its policyholders.[10][11]

In 1984, Manulife announced that it had acquired Waterloo, Ontario-based Dominion Life Assurance Company, a deal that included the purchase of all of the outstanding stock of the company from Lincoln National.[12][13] Dominion Life was founded in Waterloo in 1889, and Manulife made a commitment to the community to retain a significant presence in Waterloo. In 1988, Manulife opened a new five-storey office building at 500 King Street North in Waterloo to house its Canadian Division.[14]

In 1996, the company entered an agreement with Sinochem to form Shanghai-based Zhong Hong Life Insurance Co. Ltd., China's first joint venture life insurance company, and was granted a license that made it the second foreign insurer[15] to be allowed re-entry into China.[16]

Demutualization and public company[edit]

In 1999, its voting eligible policyholders approved demutualization, and the shares of Manulife, the holding company of The Manufacturers Life Insurance Company and its subsidiaries, began trading on The Toronto Stock Exchange (TSX), the New York Stock Exchange (NYSE) and the Philippine Stock Exchange (PSE) under the ticker 'MFC', and on The Stock Exchange of Hong Kong (SEHK) under the ticker '945'.[17][better source needed]

In 2002, Manulife–Sinochem Life Insurance Co. Ltd. was granted approval by the China Insurance Regulatory Commission (CIRC) to open a branch office in Guangzhou, China, the first branch license granted to a foreign invested joint–venture life insurance company. In 2003, Manulife-Sinochem received approval for a branch office in Beijing, the first multiple-branch license granted to a foreign-invested joint venture life insurance company. The firm is now licensed to operate in more than 50 Chinese cities.[17]

On September 29, 2003, Manulife announced its intent to acquire the Boston-based insurance company John Hancock Financial (including a Canadian subsidiary, Maritime Life) for $10.4 billion in a stock-for-stock merger. The merged entity would initially be led by John Hancock's CEO David F. D'Alessandro, but he would step down in June 2004.[18][19][20]

In September 2009, the company purchased AIC's Canadian retail investment fund business.[21] In October 2009, it purchased Pottruff & Smith Travel Insurance Brokers Inc., a Canadian broker and third party administrator of travel insurance.[22]

In 2010, the company announced that it had purchased Fortis Bank SA/NV's 49% ownership in ABN AMRO TEDA Fund Management Co. Ltd. The new joint venture, Manulife TEDA Fund Management Company Ltd. (Manulife TEDA), provides traditional retail and institutional asset management for clients in China. The other 51 per cent is owned by Northern International Trust, part of Tianjin TEDA Investment Holding Co., Ltd. (TEDA).[23]

In June 2012, the company opened Manulife Cambodia, with headquarters in Phnom Penh.[24][25]

In 2013 Richard DeWolfe became the chair of the company's board,[26] succeeding Gail Cook-Bennett, who retired after serving 34 years on the board.[27] In 2009, Donald Guloien, the chief investment officer, succeeded Dominic D'Alessandro as president and CEO of the company. Shortly before his departure, D'Alessandro modified his retirement package; the restricted units would only vest for a total of $10 million if the shares reached $36 by the end of 2011, and he would receive $5 million if the shares hit $30. This was in response to shareholders' reaction to the first quarterly loss ever posted by the firm in its public history. Under Guloien's leadership, the first initiatives were a dividend cut and an equity offering to bolster Manulife's capital levels, making it difficult for the share price to reach the target levels needed to vest.[28]

In September 2014, Manulife agreed to acquire the Canadian operations of Standard Life for a fee of around $3.7 billion USD.[29]

In 2014, Manulife Financial simplified its logo and brand to refer to itself only as Manulife outside of the United States.[30]

In April 2015, the company announced a partnership with DBS Bank, providing Manulife exclusive access to DBS customers in Singapore, Hong Kong, China and Indonesia in exchange for an initial payment of $1.2 billion USD.[31]

In June 2015, Manulife-Sinochem became the first foreign invested joint-venture life insurance company in China authorized to sell mutual funds.[32]

In May 2016, Manulife US real estate investment trust became a public company via an initial public offering on the Singapore Exchange.[33]

In April 2016, Manulife became the first Canadian insurance company to offer life insurance to people who are HIV-positive, insuring people who have tested HIV-positive, who are between the ages of 30 and 65, and meet certain other criteria for life insurance policies that would pay up to $2 million upon death.[34]

See also[edit]

References[edit]

- ^ abcde'Statistical Information Package Q4 2016'. Manulife. Retrieved 9 February 2017.

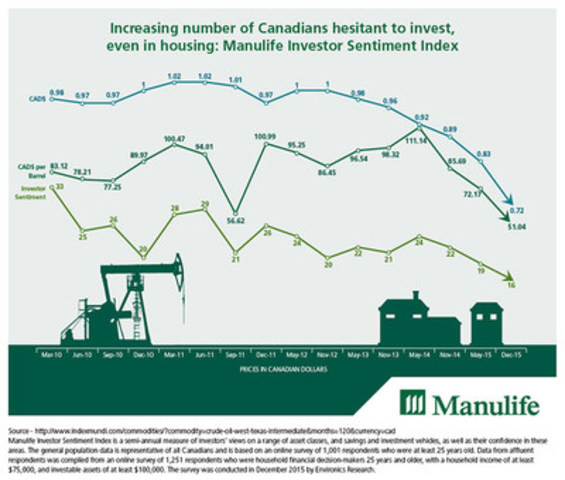

- ^ ab'Increasing number of Canadians hesitant to invest, even in housing'. Manulife. 15 February 2016. Retrieved 15 February 2016. Archived 7 March 2016 at the Wayback Machine

- ^Trichur, Rita (August 8, 2007). 'Manulife makes $1.1B profit'. Toronto Star. Retrieved January 22, 2013.

- ^'Our Story'. m.manulife.com. Retrieved 2018-12-26.

- ^'Manulife Asset Management'. Retrieved 6 November 2016.

- ^ abYusufali, Sasha (16 December 2013). Manulife Financial Corporation. The Canadian Encyclopedia. Historica Canada. ISBN978-0771020995.

- ^McQueen 2009, p. 35.

- ^ abMcQueen, Rod (2009). Manulife: How Dominic D'Alessandro Built a Global Giant and Fought to Save it. Toronto: Penguin Group. p. 36. ISBN978-0-670-06920-0.

- ^Bangyan, Feng & Kau, N. M. (2010). Enriching Lives: A History of Insurance in Hong Kong 1841–2010(PDF). p. 39, par. 2–3.

- ^'Ratify Mutualization Of Manufacturers Life'. Financial Times. Montreal. August 8, 1958.

- ^Bliss, Michael (1990). Northern Enterprise: Five Centuries of Canadian Business. McClelland & Stewart. p. 495. ISBN978-0771015694.

- ^Welsh, Lawrence (30 October 1984). 'Dominion Life is acquired by Manulife'. The Globe and Mail. Toronto.

- ^McQueen 2009, p. 54.

- ^Strathdee, Mike (16 July 1988). 'Moving experience: Manufacturers Life relocates in stages'. Kitchener-Waterloo Record.

- ^'Insurance Hall of Fame: Dominic D'Alessandro'.

- ^McQueen 2009, p. 110.

- ^ ab'Our story'. Manulife Financial. Retrieved 23 February 2017.

- ^'Manulife to buy John Hancock in massive deal'. The Globe and Mail. Retrieved 2018-10-31.

- ^Caffrey, Andrew, 'Hancock chief D'Alessandro stepping down', Boston Globe, June 11, 2004

- ^'Manulife buying John Hancock for $15 billion'. CBC News. Retrieved 2018-10-31.

- ^Trichur, Rita; Acharya, Madhavi & Yew, Tom (13 August 2009). 'Manulife buys AIC as Lee-Chin retreats'. Toronto Star.

- ^'Manulife buys Woodbridge brokerage Pottruff & Smith'. Toronto Star. 15 October 2009.

- ^'Manulife Financial – Transactions'. Archived from the original on 2012-09-03.

- ^'Manulife expands ASEAN reach with Cambodia office'. Reuters. 28 June 2012.

- ^'Manulife Enters Cambodia Market With Phnom Penh Office'. Bloomberg News. 9 June 2015.

- ^'Board of Directors'. Manulife.

- ^'Manulife names Richard DeWolfe next chairman after Gail Cook-Bennett retires'. Financial Post. The Canadian Press. 30 November 2012.

- ^Decloet, Derek (18 April 2009). 'Bruised D'Alessandro offers olive branch'. The Globe and Mail. Retrieved 9 September 2013.

- ^Rocha, Euan & Hodgson, Jeffrey (4 September 2014). 'Manulife to buy Standard Life's Canadian assets for $3.7 billion'. Reuters.

- ^'History of the Manulife Logo'.

- ^Schecter, Barbara (8 April 2015). 'Manulife pays US$1.2B to get its foot in the door at DBS Bank in latest Asian expansion'. Financial Post.

- ^'Manulife gears up for growth in China'. South China Morning Post. 10 February 2014. Retrieved 24 February 2017.

- ^Aravindan, Aradhana (20 May 2016). 'Manulife US REIT debuts in Singapore slightly below IPO price'. Reuters.

- ^Evans, Pete (22 April 2016). 'Manulife to offer life insurance to HIV-positive Canadians for 1st time'. CBC News.

Manulife Financial Stock

External links[edit]

| Wikimedia Commons has media related to Manulife Financial. |

- Manulife Financial Corporation at The Canadian Encyclopedia