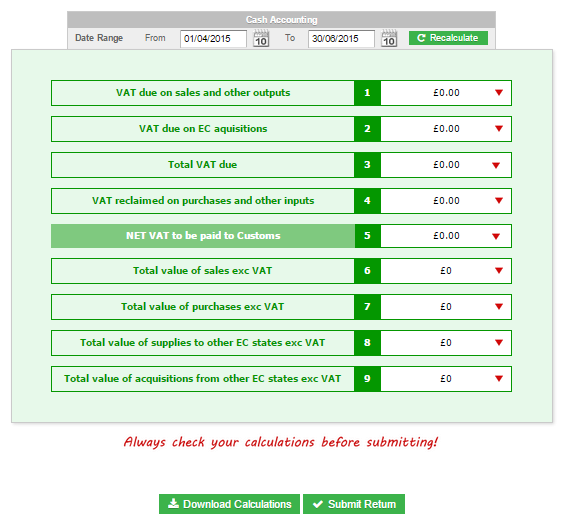

Excel Vat Return Template Uk

- How To Download Vat Return Template

- Vat Returns

- Vat Return Template Uae

- Uk Vat Return Form

- Uk Vat Return Due Date

- Sars Vat Return Template

- Vat Return Forms

Every business entity has to issue a UAE VAT Credit Note, whenever the goods are returned or the is invoice issued is overbilled.

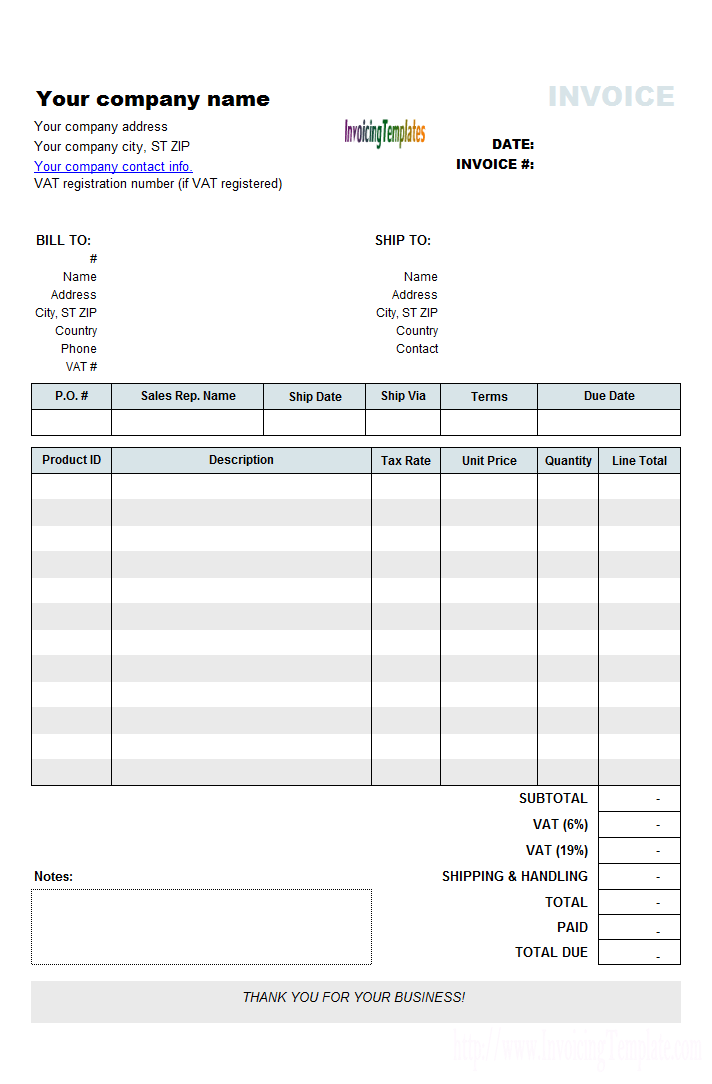

Invoice Template with Value Added Tax – 14+ Free Word, Excel, PDF Format Download. At Tax Invoice Templates, you can search templates that have the inclusion of the value added tax for all the goods and services that customers are paying to in the form of Excel format. How to complete a VAT return for HMRC. Taking into account tax points, input VAT, Output VAT your expense VAT, Invoice VAT and VAT liability. The VAT due on all tax points needs to be declared in the VAT return at the end of the quarter containing the tax point. The amount of VAT due is Output VAT minus Input VAT.

VAT in UAE is expected to be implemented in from 1st January 2018. Businesses must be ready for VAT billing system.

A Credit note is a document issued by a supplier on a customer reduction or discount in the price on the original VAT invoice.

Payment of VAT to the government reduces on account of Credit Notes.

Basically, goods return or reduction in billing amount reduces your tax liability as the goods or services supplied have been reduced by that amount.

Usually, VAT Collected on Sales – VAT on Credit Notes = VAT payable to the government.

To know more about the VAT you can visit the official website of Ministry of Finance – UAE www.mof.gov.ae

We have created an easy to use ready excel template of UAE VAT Credit note with predefined formulas and settings.

This template can be useful to accountants, freelancers, accounts assistants etc.

Just download and change company details in the header section like your company name, logo, address and VAT number.

You can download other accounting templates like UAE VAT Invoice Template,UAE Invoice Template in Arabic, and Cash Book with VAT from here.

Let us discuss the contents of the template in detail.

Contents of UAE VAT Credit Note Template

This template consists of 2 worksheets. Database Sheet and UAE VAT Credit Note Template.

First is the UAE VAT Credit Note Template and the second one is the Database sheet which contains the list of your customers.

Serial Number Management In SAP SD Serial Number Management In SAP SD By: Rob I am following the below step: 1. Serial number system status sapo.

Database sheet contains the details of customers like customer id, customer name, customer address, customer phone, Customer VAT number and customer email address. The main purpose of creating this sheet to save time and simplify your work.

This Database sheet is linked using VLOOKUP function to the Credit Note Template.

A drop-down list has been created and you can select the customer name. When you select the customer name all the relevant details update automatically.

The Credit Note Template contains 4 sections:

- Header

- Customer Details

- Product Details

- Other Details

1. Header

Header part contains the logo of the company, name of the company, and heading of the template ” UAE VAT Credit Note”.

2. Customer Details

The Customer details section is interlinked with data validation and VLOOKUP function to the database sheet.

You need to update the database sheet once with customer details as per your requirement.

On the right-hand side, enter the Credit note number, Credit Note date and Invoice Number against which the Credit note is issued.

3. Product Details

How To Download Vat Return Template

Product details consist of columns like Description, Quantity, Unit Price and Amount. Simple mathematical computations are applied. At the end, there is the subtotal line.

Quantity X Unit Price = Amount.

4. Other Details

Other details section contains:

Vat Returns

- The amount in words

- Terms and Conditions

- Thank You Greeting

- Vat Computations

- Total Invoice amount

- Company Seal/Stamp

- Signature Section

The formula has been added in VAT computation so it will automatically calculate the VAT amount on the total amount of the bill.

It will automatically compute the % with the Subtotal amount and sum up for the final total.

We thank our readers for liking, sharing and following us on different social media platforms.

Free drivers for ASUS K8N-E. Found 14 files for Windows XP, Windows XP 64-bit, Windows 2000, Windows Server 2003, Windows Server 2003 64-bit, Windows ME, Windows 95, Windows NT, Windows XP 64bit, other, DOS, Windows 98 SE, Other, Linux, OS/2. Select driver to download.  ROG Strix GeForce® RTX 2080 OC edition 8GB GDDR6, made for driving 4K display resolution and VR. Spanning 2.7-slots, the ROG Strix GeForce® RTX 2080 keeps Turing™ chilled with a massive heatsink, Axial-tech fans, and MaxContact technology.

ROG Strix GeForce® RTX 2080 OC edition 8GB GDDR6, made for driving 4K display resolution and VR. Spanning 2.7-slots, the ROG Strix GeForce® RTX 2080 keeps Turing™ chilled with a massive heatsink, Axial-tech fans, and MaxContact technology.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

In this article you will learn how to calculate VAT in Excel by using a functions? And Which formula we can use to calculate how much VAT has been paid when the only information you have is the total amount?

Well, it is quite easy to calculate tax in excel. The VAT (Value Added Tax) is most common type of tax that is applied to goods. Now GST (Good and Services Tax) is applied to almost every kind of goods but for some products like liquors, VAT is still there. You can calculate GST in the same way. After reading this article you will know:

- VAT Calculation in Excel

Vat Return Template Uae

- How to Calculate the Selling Price of Goods.

Generic Formula of VAT calculation in Excel:

| Purchase Price * VAT% |

Generic Formula for Calculating Selling Price :

| Purchase + Taxes |

Scenario:

Let’s say we deal with drinks (all kind of). We are assuming that a different VAT% is applied to each product. And that VAT% is given. We need to calculate VAT and Selling Price.

Step 1: Prepare a Table

We prepared below the table in Excel Spreadsheet.

Step 2: Calculate the VAT amount

In Cell E2 write this formula and hit enter.

Uk Vat Return Form

| =D2*C2 |

You will have your VAT amount calculated in E4 for milk. Drag Down the formula to E10.

Note: in Vat% column ‘%’ symbol is necessary. If you don’t want % symbol then you need to write your percentage preceding with “0.” Because excel converts “number%” into “number/100”.

Step 3: Calculate Selling Price:

In Cell F2, write this formula and hit enter.

Uk Vat Return Due Date

| =C2+E2 |

The formula for selling price is ‘Cost+Taxes’ (neglecting profit here). We are assuming that VAT is only tax that is applied to your product. Then the cost is Purchase +VAT amt Taxes.

And it is done. Your Vat Calculator in Excel is ready.

Sars Vat Return Template

You can add Totals in the bottom row or In the rightmost column like most newbies do. But the smart way of showing Totals is on the top row, just above the headers so that it is always visible (if top row is frozen).

Vat Return Forms

Now you know how to calculate vat in Excel. You can use this excel tax formula to create an instant VAT calculator excel spreadsheet. You can reverse the process to create an tax rate formula in excel.

If you liked our blogs, share it with your friends on Facebook. And also you can follow us on Twitterr and Facebook.

We would love to hear from you, do let us know how we can improve, complement or innovate our work and make it better for you. Write us at info@exceltip.com